Management Policy

Medium-term Management Plan 2022

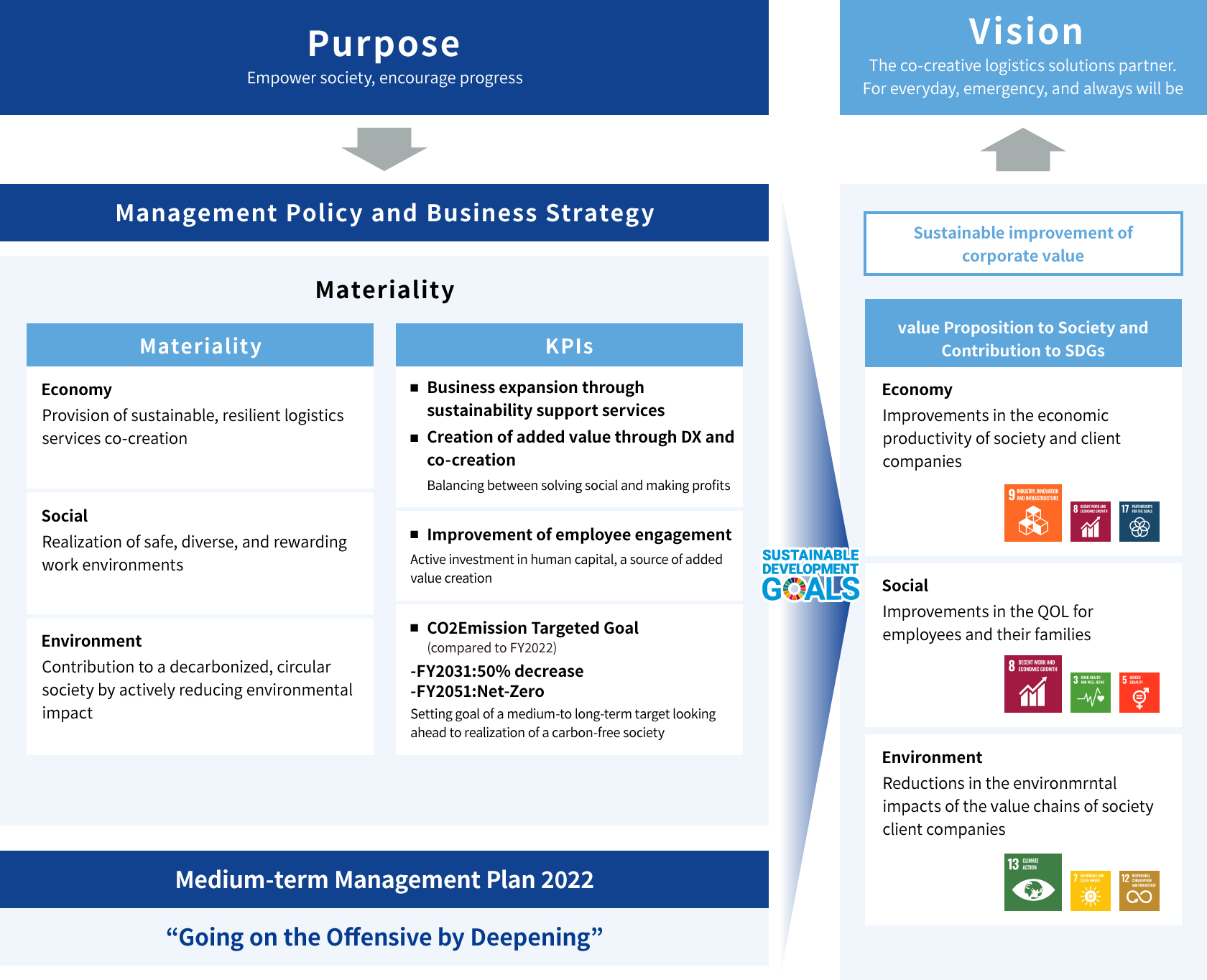

In order to realize our Vision—The co-creative logistics solutions partner. For

everyday,

emergency, and always will be— the Group has formulated a new five-year plan,

the

Medium-term Management Plan 2022,

beginning in the fiscal year ending March

31, 2023

continuing until the fiscal year ending March 31, 2027.

In our previous Medium-term Management Plan 2017, we positioned the first three

years as a

reversal period, focusing on strengthening our business profitability and

rebuilding our

financial base. In the last two years of the plan, we primarily worked on the

three key

areas for sustainable growth: Construction of Overwhelming Field Capabilities,

Establishment

of End-to-end Integrated Solution Services, and ESG Management. As a result, we

successfully

achieved all of our numerical targets, attained the reversal of our business,

and laid the

foundation for sustainable growth in the future.

Under the new Medium-term Management Plan 2022, we aim to achieve further growth

by

deepening our efforts to date. As the first-call company that can be trusted by

our

customers, we will go on the aggressive with proactive investment, focusing on

the three

pillars of our growth strategy: Top-line Growth by Mobilizing the Group's

Collective

Strength, Reinforcement of Operational Competitiveness, and Building Management

Foundations

to Support the Deepening.

Growth Strategy

Top-line Growth by Mobilizing the Group's Collective Strength

We will promote a deepening of our integrated solution services, which is our unique business model, expanding our sustainability-oriented business with our competitive abilities to make and execute proposals, and digging deeper into our inter-industry operations by making the most of the Group's broad customer base and various logistics features.

Reinforcement of Operational Competitiveness

By deepening our efforts toward thorough standardization, we will realize our "overwhelming field capabilities" that combine the power of people with the power of technology. We also aim to secure a competitive advantage by improving the quality of our operations, and furthermore, to improve profitability by lowering the cost of operations.

Building Management Foundation to Support the Deepening

We will strengthen our management base in the following four aspects:

DX

Transformation of business models and reform of corporate culture

Co-creation

Creation of mechanisms to generate innovation and the strengthening of alliances with various platformers

Business Assets

Development of new office buildings and logistics facilities, enhancement of the asset value of existing facilities, and the improvement of the work environment

ESG

Reinforcement of efforts to realize a decarbonized society, an expansion of investment in human capital, and the enhancement of governance

Financial Strategy

In the Medium-term Management Plan 2017, we restrained investment and reduced interest-bearing debt in order to rebuild our financial base. In the Medium-term Management Plan 2022, we aim to achieve both proactive investment and enhanced shareholder returns based on the financial base and profitability established in the previous medium-term management plan.

Make an investment of 130 billion yen in total.

- 100 billion yen for strategic investment in growth areas, such as DX investment, investment in new equipment (physical distribution/real estate), and M&A

- 30 billion yen for ordinary investment (investment in maintenance/renewal of existing facilities)

Strengthen shareholder returns based on a payout ratio of 30%.

Procure and operate based on the optimal debt-to-equity ratio of 1.

Set a target of return of equity (ROE) of over 12%, aiming to maintain a high level of capital efficiency.

Numerical Targets (as of March 31, 2027)

| Operating Revenue | 350 billion yen |

|---|---|

| Operating profit | 23 billion yen |

| Operating cash flow | 30 billion yen |

Relationship between the Mid-term Management Plan and the Group Philosophy

- HOME

- Investor Relations

- Management Policy

- Medium-term Management Plan 2022